The main issue in the upcoming Canadian election appears to be related to President Donald Trump and the tariffs imposed on Canada. The question appears to be: You can best stand up to Trump, the new Liberal leader and current Prime Minister, Mark Carney, or the leader of the opposition, Pierre Poilievre?

Forgotten is the awful economic track record of the Trudeau government, a government that was advised by Mark Carney. Liberals tout Mr. Carney’s experience as Governor of the Bank of Canada during the economic crisis and then as Governor of the Bank of England during Brexit. The former crisis was the result, in essence, of financial institutions bundling of good and bad mortgage loans into financial products that were rated AAA and eagerly bought by large investment houses. When homeowners defaulted on bad loans, the scheme collapsed, with central banks springing into action to contain the damage to the economy. Because of Canada’s tight regulations regarding mortgages, it impacted to a lesser degree by the impact than the US, for example. Further, Canada’s finance minister at the time, Jim Flaherty, guided the country through the crisis. With Flaherty’s help, Carney simply adopt the policies implemented by the US Federal Reserve and its chairman, Ben Bernanke, to Canada where financial institutions were less exposed.

According to former British PM, Liz Truss, “Mark Carney was the governor of the Bank of England who printed money to a huge extent, creating inflation” as well as a “pensions crisis”. “He did a terrible job in Britain of the governorship of the Bank of England.” Truss warns that Carney’s policies are no different than those pursued by the Liberal government under Trudeau.

While Canada should be one of the richest countries in the world because of its abundant (even vast) energy resources, it lags behind many developed countries because of its refusal to exploit its natural resource wealth. Expect an even greater efforts to pursue a green agenda under a Carney-led government.

Green Agenda

What is also forgotten is that Mark Carney supports the green agenda, more so perhaps than even Elizabeth May of Canada’s Green Party. As the UN Special Envoy on Climate Action and Finance Mark Carney launched the Glasgow Financial Alliance for Net Zero (GFANZ), also referred to as the Net Zero Banking Alliance. The idea was to ‘force’ financial firms to follow the science and invest in green energy. The science remains unsettled and, indeed, appears more questionable now than when the climate change agenda was first pursued with the establishment of the Intergovernmental Panel on Climate Change (IPCC) in 1988. A good example of this is Steven Koonin’s book, Unsettled, although despite efforts by the environmental lobby to silence dissent one can find thousands of examples of (peer-reviewed) research questioning the idea that humans are responsible for global warming. For example, Nobel prize winners Ivar Giaever (Physics, 1973), Kary Mullis (Chemistry, 1993), and John Clauser (Physics, 2022) have questioned the notion of human-caused climate change, with Clauser referring to it as a “dangerous corruption of science.” Environmentalists attempt to silence these and other scientists, including many physicists, by arguing that they are not climate scientists, and thus cannot comment on things outside their area of expertise. Nonsense! This argument would sideline the vast majority of so-called ‘climate scientists’ as many are no more than computer modelers writing code that may have nothing to do with the real world.

Leaving this disagreement aside, it is the policy side of climate change that is most frightening. Fortunately, most financial institutions have now abandoned the Net Zero Banking Alliance (a Carney failure) and are focusing on their fiduciary responsibility to enhance the wealth of pension funds, for example. However, some countries continue to pursue their legislated target of achieving Net Zero Emissions by 2050—the green transition. Leaders in the pursuit of Net Zero are the United Kingdom and Germany, with the UK aggressively pursuing the energy transition for the past decade or more, with the approval and support of the Bank of England during the period 2013-2020 while Carney was its Governor. How has the transition worked out for England? The economy is in a tailspin and energy costs have gone through the roof. This is seen in the following graph, with each UK households paying more than £400 ($608) annually to support electricity produced from renewable energy sources, including biomass sourced from as far away as British Columbia.

Source: GB News

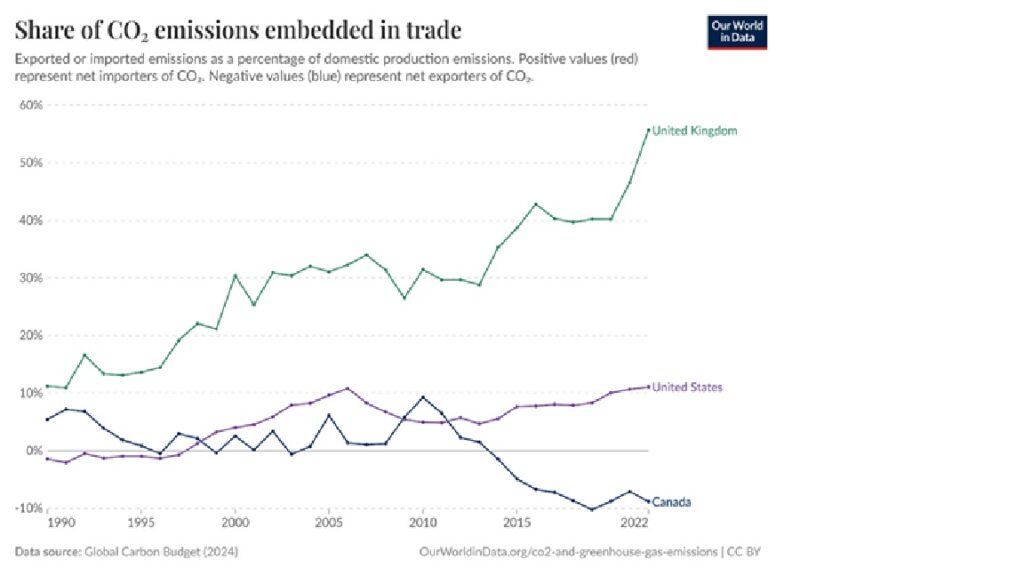

In the meantime, the UK has outsourced much of its manufacturing to countries such as China. The UK now imports goods that account for 56% of the UK’s “consumption CO2” emissions (see chart).

The term ‘consumption CO2’ was used by Mark Carney on his first day at Prime Minister—he would remove the hated ‘consumption’ carbon tax. Rather, he would focus on “production CO2″ emissions. Interesting! A tax is a tax after all, with the tax on production CO2 making little difference to final consumers. They would pay the tax whether it was hidden or not—the only difference is that the tax is now hidden. However, since Canada is a net exporter of CO2 emissions embedded in products (see chart), the tax should provide greater revenue for the federal government at the expense of any province exporting energy products (oil, gas, electricity) and manufactures (e.g., steel and aluminum).

Trade Dispute with the US

Finally, what about the trade dispute (see also an earlier post)? Who is better suited to take on Trump—Carney or Poilievre? Neither! No Canadian politician seems to have the nerve to do what is needed

The United States and Canada are engaged in a trade war. On April 3 the US imposed a 25% tariff on steel, aluminum, and automobiles and automotive parts that are not produced in the US. Canada is a particular target as automotive trade between the two countries has progressively become more integrated over the past decades. Imposition of tariffs on other products now appears to be in abeyance.

Initially, Trump had declared that he would impose tariffs of 25% on all Canadian imports beginning in February 2025. This was then delayed until the beginning of March, and then April. Then, in late March, the focus of tariffs shifted to the products indicated.

The response of Canadian politicians has been rather naïve and unhelpful. They seem not to have figured out what Trump really wants, although perhaps no one knows what he truly desires. But the Canadian side has focussed on such things as retaliatory measures and lobbying to ensure that certain industries are exempt. Additional responses have included implementation of an advertising campaign to get consumers to prefer Canadian products—a ‘Made in Canada’ preference. It’s even been proposed that by lowering trade barriers between provinces, the Canadian economy can offset a trade war with the US This begs the question: Why hasn’t this already been done if it leads to such great benefit?

And now we find the Prime Minister talking nonsense about decoupling Canada from the US—refocussing Canada’s trade elsewhere. Consider the facts: In 2023, Canada’s total merchandise exports amounted to approximately $767 billion. Exports to the US accounted for $595 billion, or 77.6%. China accounted for $31.1 billion, or roughly 4.0%; remainder went to the UK (2.3%), Japan (1.7%), and various countries, primarily Mexico, the Netherlands, South Korea, Germany, India, and Hong Kong.

Given its reliance on the US, Canada needs to consider what it would take to prevent a trade war, one which would harm Canada to a much greater extent than the US. Canada ‘s economy is simply too intertwined with that of its neighbor. I suggest it would take three things.

1. Canada must eliminate its supply management regimes in dairy, eggs, chicken, and turkey. One trigger that led to the renegotiation of the North American Free Trade Agreement (NAFTA) was Canada’s reclassification of a newly developed, ultra-filtered milk protein product from a protein import to a dairy import as the Canadian Dairy Commission specifically created a new milk product category to halt imports by Wisconsin dairy producers. The result was the United States-Mexico-Canada Agreement (USMCA). Today the US administration looks at tariffs between the two countries and see one red flag—the more than 200% tariff that Canada imposes on many dairy products coming from the US.

There is almost near consensus among economists that supply management, especially in the dairy sector, constitutes a market distortion that harms Canadian consumers, especially the poor. Supply management was abandoned by both the EU (2015) and Australia (2000). Several studies have indicated that Canada and its dairy producers would benefit from the elimination of supply management because it would provide access to lucrative export markets while reducing the high costs of managing the program. Despite this, Canada’s politicians have come out strongly in favour of retaining supply management.

Rather than driving the Canadian economy into recession through a trade war, it would be wise to offer to eliminate supply management in these sectors to avoid punitive US tariffs on all Canadian goods.

2. Canada and Greenland stand between Russia and the US. Any missile attack on the US would fly over these jurisdictions. Further, as warming continues, there is likely to be more shipping activity, mining, and extraction of oil and gas in the Arctic. Importantly, the Arctic is likely to become militarized with US, Chinese, Russian and, perhaps, other countries’ warships active in the region. According to the International Monetary Fund (IMF), interest payments on Canada’s combined federal and provincial debt constitute approximately 3.2% of the country’s Gross Domestic Product (GDP). In contrast, Canada allocated approximately 1.37% of its GDP to defense spending in 2024, which is below NATO’s target of 2% for member countries. Former Prime Minister Justin Trudeau committed to reaching the 2% target by 2032, though the US is extremely critical of this timeline and wants to see Canada increase its defense spending by much more in a shorter period. Canada has one of the lowest defense commitments in NATO and that other NATO countries are in the process of shoring up their defense budgets. To forestall a trade war with the US, Canada should commit to increasing its defense budget to reach 2% within two years and equal what it spends on interest payments by 2030.

3. Finally, to avoid a trade war, Canada should offer to begin negotiations with the US to establish a Customs Union. This would imply a single border with respect to imports from outside the Union and might even lead to the adoption of a single currency (obviously the USD). The history of the EU could serve as a blueprint regarding what implications any decision might have and what potential pitfalls to avoid.

Summary

What then can one expect of a future Canadian government? A Carney-led government will differ little from what we have seen of the Liberal government during the Justin Trudeau years. The PM will look less foolish or Biden-ish than the previous PM but will lead the country down the green road to potential economic ruin given the experience of the UK (and some other countries) that continue to pursue ‘Net Zero’. Would a government led by Pierre Poilievre be any different. Probably not that different, except perhaps more willing to abandon the oil and gas industry in its pursuit of ‘Net Zero’.

More important at this time is the trade debacle. Despite a 97% consensus among economists that supply management gouges the Canadian public, especially the poorest in our society, and that the dairy sector would be better served in the long run by allowing unfettered access to the US and other foreign markets, politicians have failed miserably in challenging the power of the dairy lobby. Currently, the politicians seem more than willing to sacrifice untold billions of dollars and associated employment to protect a highly entrenched monopoly that transfers income from the poorest in society to a small number of wealthy farmers who are more efficiently protected from market and other vagaries by Canada’s existing agricultural risk management programs.